What is a Harmonic Trading The Cypher Pattern for Cheap?

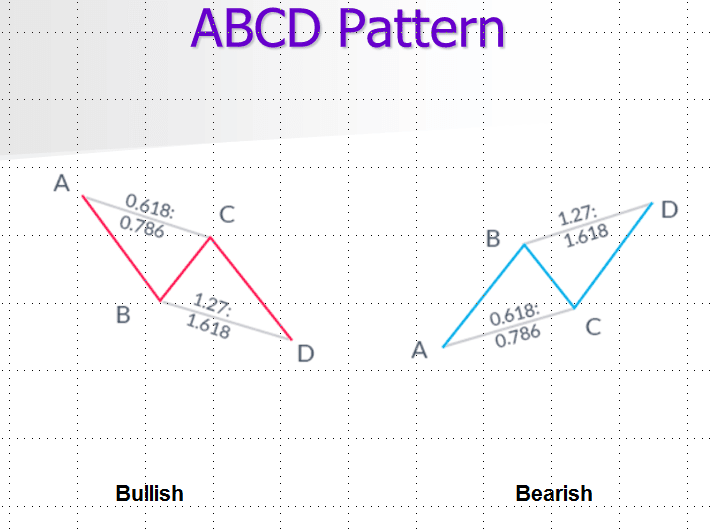

In this pattern, the A to B leg is the first price move. After a brief retracement from point B to point C, the pattern will complete the C to D leg, which is the same length as AB. Simply, after the AB and BC legs have been established, you project the AB length from point C… Although the price action will not always be exactly equivalent, the AB=CD legs usually will be close enough to determine the reversal points. Sometimes, this pattern will be exact but I usually wait for the CD leg to at least equal the AB leg.

The Fibonacci numbers in the pattern must occur at specific points. In an ideal AB=CD Pattern™, the C point must retrace to either a 38.2% at a minimum to validate the structure. The maximum retracement of the AB leg is an 88.6% level that defines a less extreme AB=CD pattern formation but still valid. This retracement sets up the BC projection that should converge at the completion of the AB=CD and be within a 1.13-2.618. It is important to note the reciprocal nature where a 0.618 retracement at the C point will result in a 1.618 BC projection while a 0.786 retracement at the C point will result in a 1.27 projection. The most important consideration to remember is that the BC projection should converge closely with the completion of the AB=CD.

Harmonic Trading The Cypher Pattern Index:

📁 SAnet.me.UyHarmonicTradingABCDPattern

📄 001 Disclaimer.mp4 (19.43 MB)

📄 002 Introduction To Harmonic Trading.mp4 (28.49 MB)

📄 003 The Potential Reversal Zone.mp4 (31.44 MB)

📄 004 The ABCD Pattern.mp4 (126.26 MB)

📄 005 The Trading Plan.mp4 (106.72 MB)

📄 006 Story of a Trader.mp4 (13.18 MB)

💬 Feel free to REACH OUT to our CHAT support for personalized assistance and detailed information tailored to your needs. We’re here to help!

Reviews

There are no reviews yet.