What is a Harmonic Trading The Cypher Pattern for Cheap?

What Is the Cypher Chart Pattern?

The Cypher is a type of harmonic pattern used by traders to identify potential buying and selling opportunities in the markets. Specifically, it’s used to help find areas where a reversal may occur.

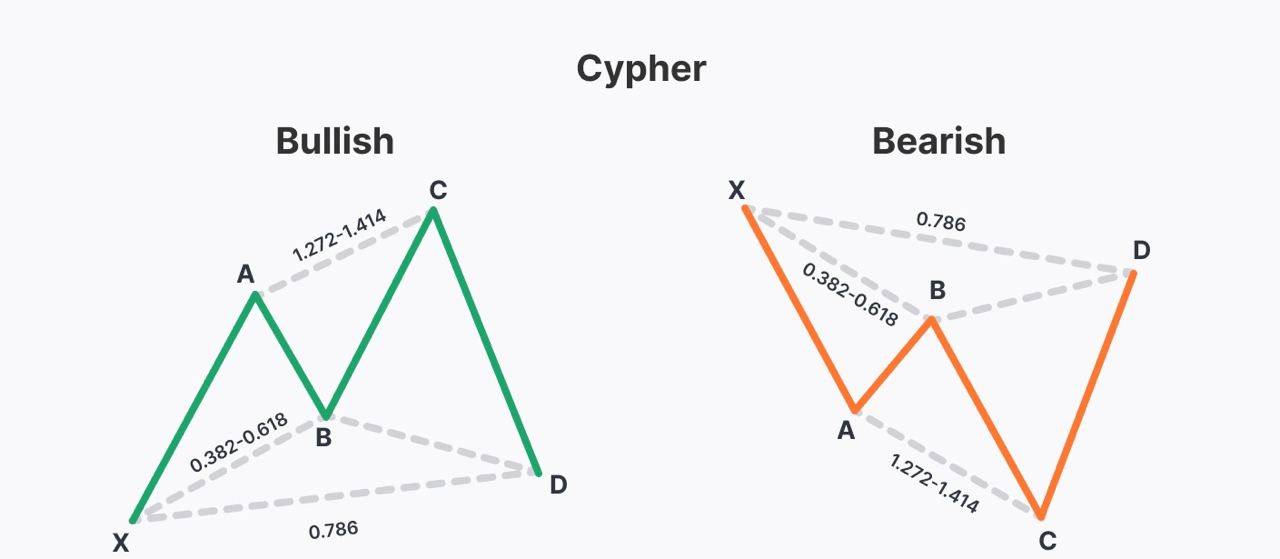

The pattern is made up of five swing points (X, A, B, C, D) and four legs (XA, AB, BC, CD). It’s characterised by an “M” shape when bullish and a “W” shape if bearish. Traders typically place orders at D to catch the potential reversal.

Like other harmonic patterns, the Cypher requires that specific Fibonacci ratios be met before it is traded. However, the ratios used for the Cypher are relatively unique, which makes the formation one of the less common harmonic patterns.

The Cypher is also more advanced than other patterns, like the Gartley, Bat, or Butterfly, so you may need to spend some extra time learning how to recognise and trade it effectively. Once you master the skill, however, you’ll find that the Cypher can be a valuable addition to your trading arsenal.

Identifying the Cypher Pattern

At its simplest, the Cypher pattern comprises an impulse leg, XA, that retraces to form AB. Another impulse beyond the swing point A creates the BC leg, and a final retracement to D generates the CD leg.

Here are the Cypher harmonic pattern rules that must also be met:

- AB retraces XA by 38.2% to 61.8%.

- BC extends XA by 127.2% to 141.4%.

- CD retraces XC by 78.6%.

Harmonic Trading The Cypher Pattern Index:

📁 01 Introduction

📄 001 Disclaimer.mp4 (12.29 MB)

📄 002 Meet Your Instructor.mp4 (18.19 MB)

📄 003 Introduction To Harmonic Trading.mp4 (15.35 MB)

📄 004 What to Expect.mp4 (15.70 MB)

📄 005 The Potential Reversal Zone.mp4 (20.33 MB)

📄 006 The Cypher Pattern.mp4 (72.74 MB)

📄 007 What Next.mp4 (26.67 MB)

💬 Feel free to REACH OUT to our CHAT support for personalized assistance and detailed information tailored to your needs. We’re here to help!

Reviews

There are no reviews yet.